Residential Care Business Owners: Are You Leaving Money on the Table?

Discover 7 Tax Strategies

Residential Care Owners Overlook.

Unlock proven tax strategies that save residential care facilities $25,000+ annually while building long-term wealth for your business.

Press Play to Watch the Video

Download your free eBook

Download your free eBook

Are you Frustrated With..

Being caught off guard by a big tax bill and no warning ahead of time?

Your tax preparer who just files your return but never gives you advice?

Paying too much in taxes and not knowing what strategies you’re missing out on?

The last-minute scramble every tax season to pull documents and meet deadlines?

You’re excellent at providing quality care and keeping your facility running smoothly, but tax strategy, bookkeeping, and long-term financial planning? That’s not where you thrive.

The truth is: You don’t need to become a CPA or financial expert. You just need the right partner and a system built for your type of business.

Picture This..

Your taxes are handled months in advance, no last-minute scrambling, no surprises.

You finally stop overpaying the IRS and start putting those savings back into your staff, residents, and growth.

You have a clear financial game plan, and you actually understand it without needing a degree in accounting.

You no longer stress over IRS letters or tax notices, because someone you trust is already on it.

Your business runs

smoother because your finances are in order, your systems are automated, and you have support when you need it.

Our free eBook, 7 Overlooked Tax Strategies for Residential Care Home Owners, is your first step toward leaving the stress and overpayments behind, and finally running your care business with clarity, confidence, and control.

Presenting: Discover 7 Tax Strategies Residential Care Owners Overlook.

Unlock proven tax strategies that save residential care facilities $25,000+ annually while building long-term wealth for your business.

If you’re tired of overpaying taxes, guessing at deductions, or being left in the dark by your CPA, this guide is your starting point.

This eBook reveals the same tax strategies successful care home owners use to reduce their tax bill by $25K+, without gimmicks or gray areas.

Inside, you’ll get the blueprint that smart operators use to legally lower taxes, protect profits, and reinvest in their facilities, with confidence, not confusion.

Unlock proven tax strategies that save residential care facilities $25,000+ annually while building long-term wealth for your business.

What You'll Learn Inside This eBook..

How to Turn Personal Expenses Into Business Deductions Many care home owners don’t realize that everyday expenses, like using your home or car, can be leveraged to reduce taxes.

You'll Learn:

How the Augusta Rule lets you rent your home to your business tax-free.

How the Home Office Deduction converts a spare room into real savings.

How the Business Auto Deduction offsets vehicle costs with little extra effort.

How to Cut Self-Employment Taxes by Thousands Most care home owners operate as sole proprietors or LLCs, and that choice could be costing them thousands.

You’ll learn:

What the S-Corp Election is and how it can lower payroll taxes.

When it makes financial sense to elect S-Corp status.

What steps are needed to stay compliant while saving.

How to Use Big-Business Strategies Without Being a Big Business These tax strategies aren’t just for corporations, they’re accessible, legal, and often overlooked by small operators.

You’ll learn:

How QBI provides a 20% deduction for qualifying income.

How Section 179 allows full write-offs for equipment and upgrades.

How the De Minimis Rule simplifies bookkeeping and speeds up deductions.

How to Build a Stronger, Tax-Smart Business Year After Year This guide isn’t just about one-time wins — it’s about long-term financial clarity and smarter operations.

You’ll learn:

Why tax planning should start before year-end, not during filing.

How to create a repeatable process for tracking and documenting expenses.

How to work with an advisor to tailor a strategy to their specific care home.

1. How to Turn Personal Expenses Into Business DeductionsMany care home owners don’t realize that everyday expenses — like using your home or car — can be leveraged to reduce taxes

They’ll learn:

How the Augusta Rule lets you rent your home to your business tax-free.

How the Home Office Deduction converts a spare room into real savings.

How the Business Auto Deduction offsets vehicle costs with little extra effort.

2. How to Cut Self-Employment Taxes by ThousandsMost care home owners operate as sole proprietors or LLCs — and that choice could be costing them thousands.

They’ll learn:

What the S-Corp Election is and how it can lower payroll taxes.

When it makes financial sense to elect S-Corp status.

What steps are needed to stay compliant while saving.

3. How to Use Big-Business Strategies Without Being a Big BusinessThese tax strategies aren’t just for corporations — they’re accessible, legal, and often overlooked by small operators.

They’ll learn:

How QBI provides a 20% deduction for qualifying income.

How Section 179 allows full write-offs for equipment and upgrades.

How the De Minimis Rule simplifies bookkeeping and speeds up deductions.

4. How to Build a Stronger, Tax-Smart Business Year After YearThis guide isn’t just about one-time wins — it’s about long-term financial clarity and smarter operations.

They’ll learn:

Why tax planning should start before year-end, not during filing.

How to create a repeatable process for tracking and documenting expenses.

How to work with an advisor to tailor a strategy to their specific care home.

The Clarity-to-Growth Framework™

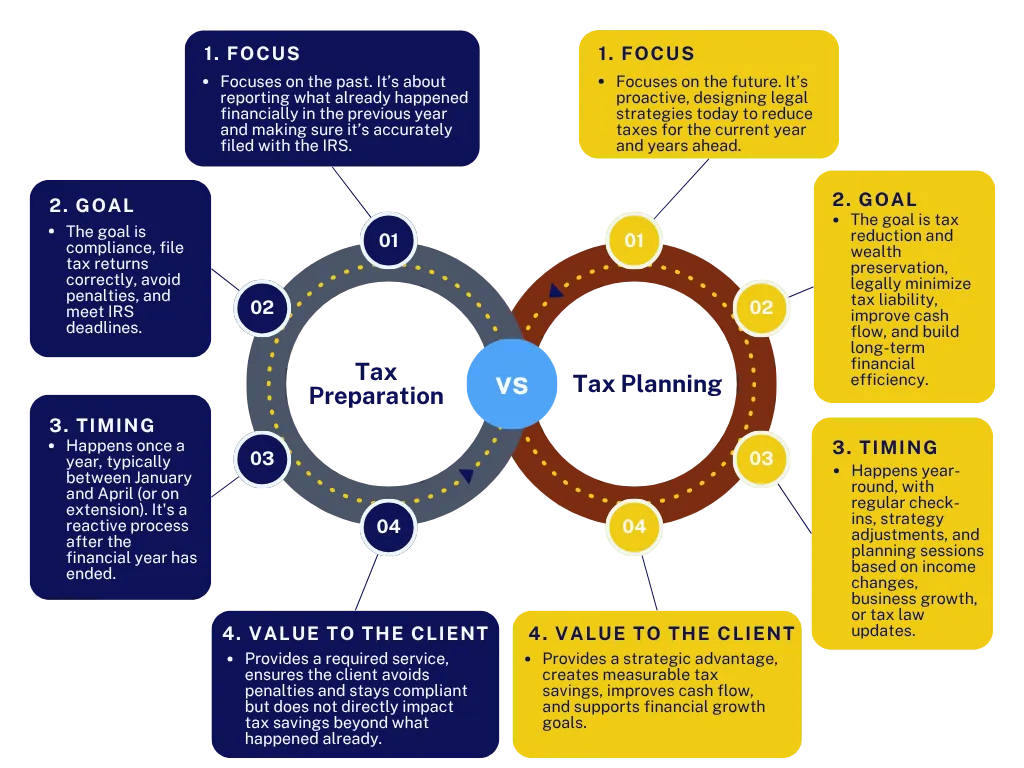

Tax Planning Vs Tax Preparation

Meet The Company

CGX Advisors

Strategic Financial Clarity Built for Care

At CGX Advisors, we specialize in helping Residential Care Business Owners take control of their finances by reducing taxes, improving cash flow, and setting the foundation for long-term growth. With over 15 years of experience and a deep understanding of the tax code, our team knows what it takes to guide care-based businesses through each phase of their financial journey. Whether you're overwhelmed during tax season or unsure how to scale profitably, we offer personalized support and a proven framework that brings clarity and confidence to your operations. Our mission is to give you the freedom to focus on delivering exceptional care while we handle the numbers. If you’re looking for a financial partner who understands your business and your goals, CGX Advisors is here to help.

What We Offer: Comprehensive support designed specifically for Residential Care Business Owners:

Tax Preparation – Timely, accurate, and stress-free filing tailored to your business

Tax Planning – Strategic guidance to minimize liability and uncover overlooked deductions

Bookkeeping – Reliable, organized tracking so you always know where your business stands

CFO Services – High-level financial strategy and reporting to help you make smarter decisions

Frequently Asked Questions..

How do I know if these strategies apply to my care facility?

If your Residential Care Home is generating income, and you're paying taxes, chances are at least a few of these strategies apply to you. Even if you’re a sole proprietor or run a small operation, options like the Augusta Rule, QBI deduction, and Section 179 can still help you save thousands. A quick review with a tax strategist can confirm which ones you’re missing out on.

What’s the difference between tax planning and tax preparation?

Tax preparation happens after the year is over, just reporting the numbers. Tax planning happens before year-end and focuses on minimizing how much you’ll owe by applying strategies like the ones in this eBook. Most care home owners overpay because they only get tax prep, not proactive planning.

Is the S-Corp election right for my business?

It depends on your profit level. If your care home is bringing in over $50,000 annually in net income, electing S-Corp status could save you thousands in self-employment taxes. But it does come with formalities like payroll and recordkeeping, so you’ll want to review it with a qualified advisor.

Will using these strategies increase my risk of an audit?

No, these are IRS-approved strategies, not loopholes or shady tactics. As long as you follow the compliance checklists (e.g., documentation, agreements, fair market values), you’re simply playing by the rules with confidence. In fact, implementing them properly may reduce red flags.

Discover tax strategies used by successful residential care facilities to save over $25,000 each year, while setting your business up for long-term financial growth.

CGX Advisors · All Rights Reserved · Privacy ·Terms and Conditions

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way.

FACEBOOK is a trademark of FACEBOOK, Inc.

CGX Advisors

245 Riverside Ave., Ste 100 Jacksonville, FL 32202